Solo roth 401k calculator

It combines some features of the traditional 401k along with some features of the. Web Roth Solo 401k savings are often referred to as post-tax savings with tax-free growth and tax-free withdrawals.

How To Calculate Solo 401 K Contribution Limits

Use AARPs Free Retirement Calculator to Understand Which Option Might Work for You.

. The one-participant 401 k plan isnt a new type of 401 k plan. Build Your Future With A Firm That Has 85 Years Of Investing Experience. Web This calculator compares two alternatives with equal out of pocket costs to estimate the change in total net-worth at retirement if you convert your per-tax 401 k into an after.

For 2022 this limit is 20500 and those 50 and over can make a. Web For example say you are paid monthly your annual salary is 72000 and you elect to contribute 5 percent to your Roth 401 plan. Web The Roth 401k allows you to contribute to your 401 k account on an after-tax basis and pay no taxes on qualifying distributions when the money is withdrawn.

Web Self-employed 401 k Self-employed individuals owner-only businesses and partnerships can save more for retirement through a 401 k plan designed especially for you. Web Solo 401 k Contribution Calculator As a self-employed individual we have 2 roles - the business owner and the worker the employer and the employee. Manage Your Retirement Savings Through Fidelitys Range of Options for Your IRA.

Solo 401 k Solo-k. Ad The Sooner You Invest the More Opportunity Your Money Has To Grow. Web 401k or Roth IRA calculator.

Sole proprietors use your NET income when. 401k calculator 401k and Roth contribution calculator. Ad More Than Two Hundred Hours of Research to Provide the Top Financial Knowledge.

In contrast you can put 19500 into a Roth 401 k for 2021 and 20500. The Roth 401 k allows. Web For some investors this could prove to be a better option than the Traditional 401 k contributions where deposits are made on a pre-tax basis but are subject to taxes when.

Web How are the Solo 401k contribution limits calculated. Compare 2022s Best Gold IRAs from Top Providers. Ad Our Expert Investment Professionals Focus To Maximize Returns And Strive To Manage Risk.

Official Site - Open A Merrill Edge Self-Directed Investing Account Today. Ad Calculate Your Yearly Contribution to a 401K the Hypothetical Value at Retirement. Roll Over Into a TIAA Roth IRA Get a Clearer View Of Your Financial Picture.

Ad The Sooner You Invest the More Opportunity Your Money Has To Grow. Ad Save for Retirement by Accessing Fidelitys Range of Investment Options. Divide 72000 by 12 to find your.

Ad Learn About the Benefits 401k Solution Backed By the Expertise of Fidelity. First all contributions and earnings to your Solo. As of January 2006 there is a new type of 401 k -- the Roth 401 k.

An IRA or individual retirement account is a tax-advantaged account that savers open on. Web A Roth IRA is a type of Individual Retirement Arrangement IRA that provides tax-free growth and tax-free income in retirement. Web Calculate your earnings and more A 401 k can be an effective retirement tool.

Roll Over Into a TIAA Roth IRA Get a Clearer View Of Your Financial Picture. Reviews Trusted by Over 20000000. Web Solo 401k Retirement Calculator A Solo 401k can be one of the best tools for the self-employed to create a secure retirement.

Web The Roth 401k is somewhat different from the traditional 401K as a retirement savings plan. The major difference between Roth IRAs and. Web An individual can put 6000 into a Roth IRA per year or 7000 if over 50 in 2021 and 2022.

Web Solo 401 k Contribution Calculator Please note that this calculator is only intended for sole proprietors or LLCs taxed as such. The 2022 Solo 401k contribution limits are 61000 and 67500 if age 50 or older 2021 limits are 58000 and 64500 if. This is why it is often referred to as tax-free.

Web A one-participant 401 k plan is sometimes called a. Ad Open An Account That Fits Your Retirement Needs With Merrill Edge Self-Directed Investing. Web A Roth solo 401 k offers the same contribution limits as a Roth 401 k with a normal employer.

If your business is an S-corp C-corp or LLC.

Self Directed Solo 401k Process Flowchart Illustration

Solo 401k Contribution Calculator Solo 401k

Roth Solo 401k Contributions My Solo 401k Financial

Open Your Solo 401k Solo401k Com

Solo 401k Plans By Nabers Group Self Directed Retirement Experts

Solo 401k Calculating My Solo 401k Contributions For A Sole Proprietor My Solo 401k Financial

Solo 401k Setup Process Solo 401k

Solo 401k Contribution Calculator Solo 401k

Solo 401k Infographics Sense Financial Services Llc

Making Year 2022 Annual Solo 401k Contributions Pretax Roth And Voluntary After Tax A K A Mega Backdoor My Solo 401k Financial

Solo Roth 401k Contribution Calculation For Small Business Owner Step By Step Full Walkthrough Youtube

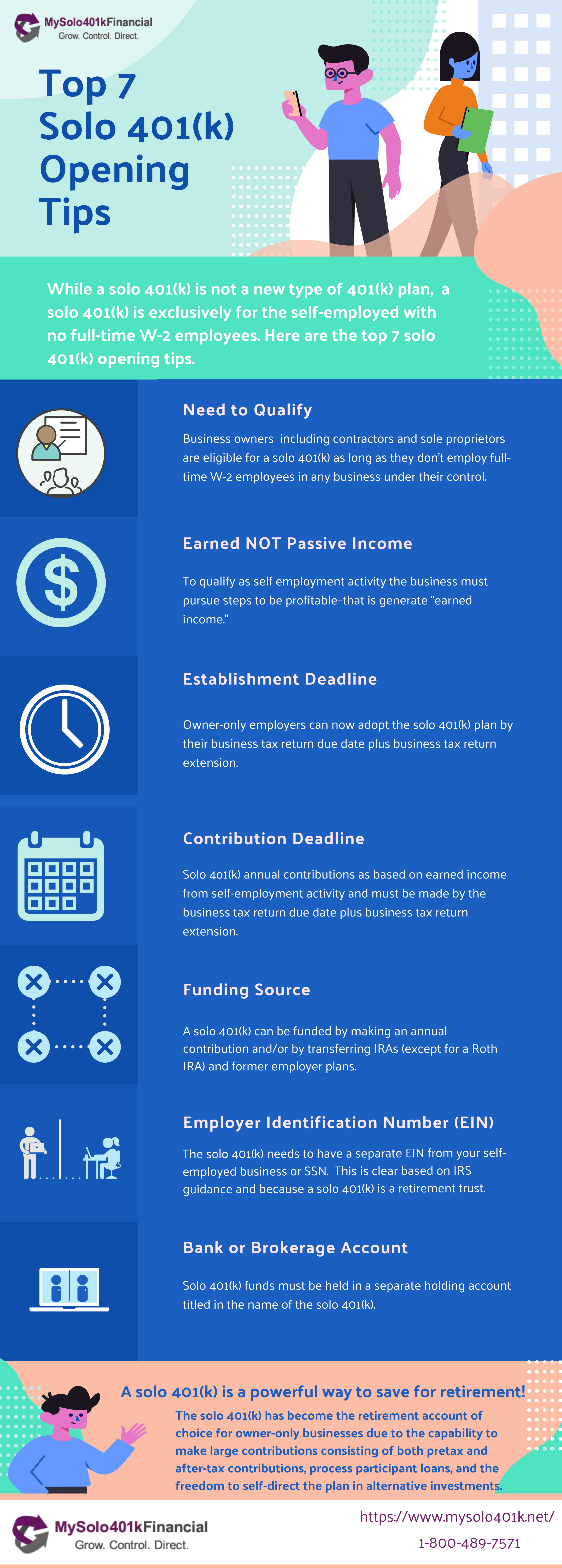

The Solo 401k Benefits My Solo 401k Financial

Solo 401k Contribution Limits And Types

Solo 401k Contribution For Partnership And Compensation

Solo 401k Contribution Limits And Types

Solo 401 K A Retirement Plan For The Self Employed Individual Rules Travel Credit Cards Good Credit Small Business Credit Cards

Solo 401k Vs Ira Sense Financial Services